Monthly Bulletin

California Department of Business Oversight

Volume 2, Number 9 – April 2015

Reminder of Requirements for California Banks That Want to Close a Branch Office

California Financial Code section 1078 states a bank may close or discontinue any branch office if the bank files a notice with the Commissioner,and the Commissioner, within 60 days after the filing of the complete notice, either issues a written statement not objecting to the notice, or does not issue a written objection to the notice. The bank can agree to extend the 60-day period.

In determining whether to object to a notice, the Commissioner must consider whether closing or discontinuing the branch office will have a “seriously adverse effect on the public convenience or advantage.”

Section 1078 requires the notice to include the following:

- The name of the bank.

- The location of the branch office proposed to be closed or discontinued.

- The location of the branch to which the closed branch’s businesses would be transferred.

- The proposed date of closure or discontinuance.

- A detailed statement of the reasons for closing the branch office.

- “Statistical or other information in support of the reasons consistent with the institution’s written policy for branch office closings.”

Additionally, the Commissioner requires the bank to provide the following information:

- A copy of the bank’s branch closure policy.

- A copy of any comments received from the public, or local, state or federal legislators.

If you have any questions, please contact Deputy Commissioner Scott D. Cameron at (916) 322-5962 or scott.cameron@dbo.ca.gov.

Mortgage Disclosure Forms:

Translations of Loan Estimate Available on DBO’s Website Aug. 1, 2015

Effective Aug. 1, 2015, the DBO will replace its foreign-language translations of the Good Faith Estimate with a new mortgage disclosure form called the Loan Estimate. The Loan Estimate will be available in English, Spanish, Chinese, Tagalog, Vietnamese and Korean on the DBO’s Forms and Applications web page.

The Consumer Financial Protection Bureau (CFPB) created the Loan Estimate to help borrowers shop for a mortgage. The goal is to help consumers better understand the terms of the products offered to them. More information about the Loan Estimate is available on the CFPB’s website at www.consumerfinance.gov.

California Residential Mortgage Lending Act (CRMLA)

Important Policy Information on New Branches and Change of Branch Location

CRMLA licensees do not have to obtain formal approval from the DBO when they want to open new branches or change branch locations. California Financial Code Section 50124(a)(10) requires licensees to notify the DBO of a new branch office or change of branch location. The statute does not require the DBO’s approval.

Licensees must provide the required notice by submitting the NMLS Branch Form or amending the existing Company or Branch Form in NMLS at least 10 days before engaging in business at the new branch or location.

While the branch or amended location will be reflected as “approved” in NMLS after 10 days, no formal approval is required. The DBO no longer will issue an acknowledgment of the notice for a branch office or amendment to a branch office. The DBO will update the Branch Application Checklists posted on the NMLS Resource Center and the DBO website later this month to clarify the notice requirement.

Some companies that do not hold a CRMLA license or have a pending CRMLA license application have filed a branch notice. Only CRMLA licensees or firms with pending applications for CRMLA licenses should file a notice for a CRMLA branch.

For entities with pending license applications, branch notifications will be considered approved concurrently with the issuance of the company’s CRMLA license.

Other applications, such as a Fictitious Business Name Statement filing, should not be included with the branch notification. The DBO will not consider such filings if included with the branch notification.

CRMLA licensees should file directly with the Commissioner a copy of the Fictitious Business Name Statement with the “filed stamp” from the county clerk’s office. CRMLA licensees may not use the fictitious business name until the Commissioner approves the use of the name.

Local Agency Depositories Must Obtain Treasurer Approval for FHLBSF Letters of Credit

The Administrator of Local Agency Security has observed that more depositories are using letters of credit from the Federal Home Loan Bank of San Francisco (FHLBSF) as security for their local agency deposits. While FHLBSF letters of credit are an eligible security, California Government Code section 53651 (p) requires depositories to first obtain the consent of the local agency’s treasurer.

The Administrator has determined notifying the local agency treasurer by letter and affording the treasurer a reasonable amount of time to opt out is sufficient to comply with the consent requirement.

For more information, contact Patrick Carroll at (415) 263-8559 or patrick.carroll@dbo.ca.gov.

DDBO Receives Awards in Workplace Charitable Giving

JDBO is proud to be the recipient of two awards for its work on Our Promise: California State Employees Giving at Work. The DBO received a Silver Award for participation at the 40% to 59% level, and a second award for overall campaign increase.

Our Promise: California State Employees Giving at Work (formerly CSECC) was established in 1957 to provide a single charitable fundraising drive for State workers. Our Promise offers employees the opportunity to utilize payroll deduction to support their favorite charitable organizations.

April is California Financial Literacy Month.

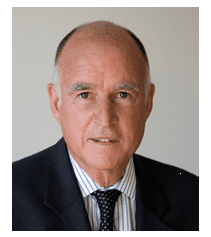

“Every day, consumers conduct transactions in a complex financial system increasingly difficult to navigate. Economic success for our families requires informed financial decisions. Financial literacy empowers Californians to make wise financial decisions, improves the quality of their lives, and provides them with skills to achieve their financial goals.”

–Governor Edmund G. Brown, Jr.

Read the commemorative letter from Governor Edmund G. Brown Jr.

National Retirement Planning Week 2015 Announced

National Retirement Planning Week 2015, a national effort to help consumers focus on their financial needs in retirement, will run from April 13-17. Materials are available for National Retirement Planning Coalition members to help support the event and promote the importance of retirement planning.

Visit Retire on your terms to access the member information kit.

Governor Brown Directs First-Ever Statewide Mandatory Water Reductions

Following the lowest snowpack ever recorded and with no end to the drought in sight, the Governor recently announced actions that will save water, increase enforcement to prevent wasteful water use, streamline the state’s drought response and invest in new technologies that will make California more drought resilient.

The Governor’s plan was contained in an executive order issued Apr. 1. Among its provisions, the order requires cities and towns to reduce their water use by 25 percent.

“For more than two years, the state’s experts have been managing water resources to ensure that the state survives this drought and is better prepared for the next one,” said a press release announcing the plan.

“Last year, the Governor proclaimed a drought state of emergency. The state has taken steps to make sure that water is available for human health and safety, growing food, fighting fires and protecting fish and wildlife.

“Millions have been spent helping thousands of California families most impacted by the drought pay their bills, put food on their tables and have water to drink.”

The full text of the executive order can be downloaded at http://gov.ca.gov/docs/4.1.15_Executive_Order.pdf.

Visit SaveOurWater.com to find out how everyone can do their part to conserve water, and visit Drought.CA.Gov to learn more about how California is dealing with the drought’s effects.

Commercial Bank Activity

Acquisition of Control

Stephen S. Taylor, Jr. and the Stephen S. Taylor Roth IRA, Hennion & Walsh and First Clearing, to acquire control of Tri-Valley Bank

Filed: 3/12/15

Trust Company Activity

Sale of Partial Business Unit

Capital Guardian Trust Company, to sell its Capital Group Private Client Services Division to Capital Bank and Trust Company

Filed: 3/9/15

Premium Finance Company Activity

New Premium Finance Company

Bail Premium Financing

Abandoned: 3/31/15

Acquisition of Control

Jorge Tarquini and Alejandro Rabida, to acquire control of Newport Premium Finance, Inc.

Approved: 3/2/15

Voluntary Surrender of License

Capital Credit Group

Effected: 12/31/14

E.T.I. Financial Corporation

Effected: 3/12/14

WIUS of California, Inc.

Effected: 12/31/14

Xpress Capital Premium Finance Corp.

Effected: 12/31/14

License Revocation

Advanced Consulting Enterprises, Inc.

Revoked: 3/24/15

Advent Finance Group

Revoked: 3/24/15

American Global Finance Corporation

Revoked: 3/24/15

Bridgeport Premium Acceptance Corporation

Revoked: 3/24/15

California Millennium Financing Inc.

Revoked: 3/24/15

Meadowlands Premium Finance Company, Inc.

Revoked: 3/24/15

Foreign (Other Nation) Bank Activity

New Office

DBS Bank, Ltd.

725 South Figueroa Street, Los Angeles, Los Angeles County (Representative Office)

(In connection with the transformation of the Depositary Agency to a Representative Office)

Approved: 3/22/15

Money Transmitter Activity

New Transmitter

Alipay US, Inc.

Filed: 3/18/15

Microsoft Payments, Inc.

Filed: 3/18/15

Payoneer, Inc.

Filed: 10/16/13

Approved: 11/13/14

License Issued: 3/16/15

JAN LYNN OWEN

Commissioner of Business Oversight

The April 2015 Monthly Bulletin covers the month ended March 31, 2015. It is issued pursuant to Financial Code section 376.

The Monthly Bulletin is available without charge via e-mail. To subscribe, go to: https://dfpi.ca.gov/Resources/subscription.asp

| 1515 K Street, Suite 200 Sacramento, CA 95814-4052 (916) 445-2705 |

One Sansome Street, Suite 600 San Francisco, CA 94104-4428 (415) 972-8565 |

320 West 4th Street, Suite 750 Los Angeles, CA 90013-2344 (213) 576-7500 |

1350 Front Street, Room 2034 San Diego, CA 92101-3697 (619) 525-4233 |

| 45 Fremont Street, Suite 1700 San Francisco, CA 94105 (415) 263-8500 |

300 S. Spring Street, Suite 15513 Los Angeles, CA 90013 (213) 897-2085 |

7575 Metropolitan Drive, Suite 108 San Diego, CA 92108 (619) 682-7227 |

|

| Department of Business Oversight Consumer Services Office – 1(866) 275-2677 | |||